Rank Ventures is a different type of Venture Capital Investor

Flexible Capital | Industry Experts | Unique solutions for exceptional operators

We commit time and capital, whilst balancing the needs of the company, key stakeholders and our community of investors

Alignment

We have significant "skin in the game" in every investment we make.

We lead rounds and negotiate terms, empowering Angel investors to participate with Institutional terms and representation.

We don't take upfront or management fees.

We only make money when investors make money.

Flexibility

We are not a fund, so have no constraints on the deal format and can create solutions to suit the investors' and company’s needs.

Investors choose which companies and deals they back.

We can invest from pre-seed to series C, convertible notes and debt.

We can connect the dots between legacy funding issues and the future of a company.

Network

We are a global community of kind, generous professionals and sector experts who invest time and capital.

We regularly interact with industry leaders across the globe. These relationships have been accumulated over decades of experience in both operating and investing in businesses.

Our Partners and community are operators by nature and pro-actively engage to connect the dots within their networks.

Expertise

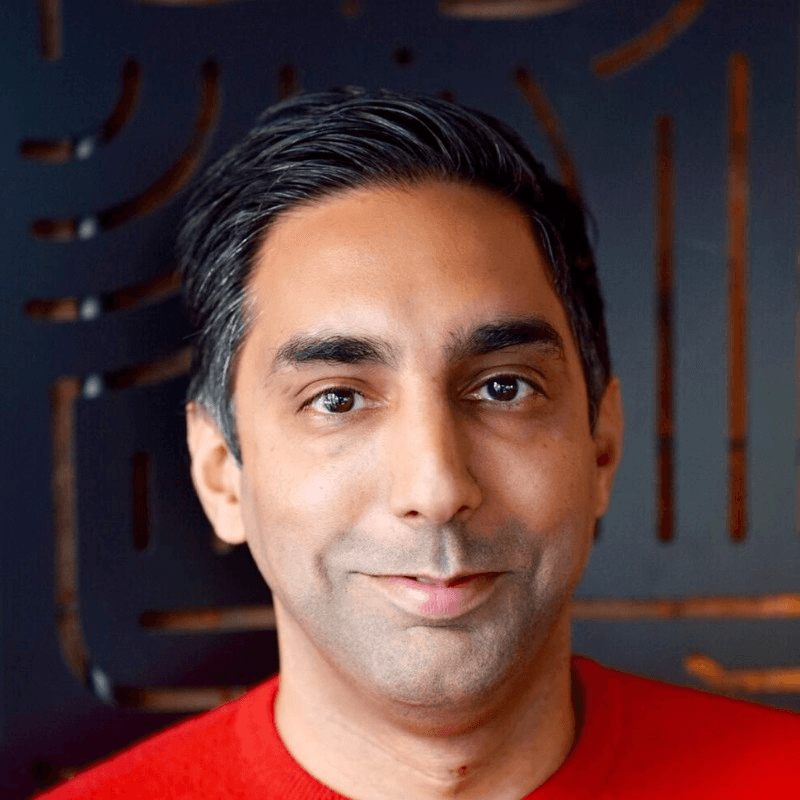

Rajan & Ankush have extensive real world business experience across many sectors and geographies.

Our investment experience spans across the capital structure, including debt and equity within both private and public markets.

Actively provide operational, commercial and strategic assistance throughout the company's journey.

We have assisted founders and portfolio companies in areas such as:

General company strategy and introductions

Hiring & team composition

Fundraising

Commercial approach and go-to-market strategy

We like Core Infrastructure technologies that have the potential to dominate or disrupt large markets.

We like businesses that have an element of IP or similar moat, whether that’s through patents, trade secrets, content, exclusive access to data or a team with deep domain expertise.

We like to work with our portfolio companies throughout their journey, often in the capacity of board directors or advisers.

AutogenAI is the world's leading AI bid writing Engine. Having invested in, advised on and successfully exited his previous company Corndel, Rank were the first call when Sean was starting his next venture.

We grew conviction around AutogenAI due to the combination of domain and sector expertise alongside a seismic shift in technology – which positions AutogenAI in a fantastic place to disrupt an extremely large but “unsexy” sector – bidding and tendering. We were delighted to see the combination of Sean and Raj come together – it’s fantastic when founders complement each other so well.

We helped Sean think through and put the initial funding round together and have subsequently continued advising the team, including on the Series A and B rounds which have followed in short order.

Edgify has built the world’s most effective serverless MLOps platform. Using their revolutionary federated machine learning framework, Edgify enables co-ordinated machine learning on thousands of low powered edge devices, without data needing to leave the edge device. This allows Edgify to get to the “holy grail” of effective deployment of AI and machine learning across distributed networks of edge devices, with the benefit of virtually zero cloud compute costs, no data privacy concerns, the possibility of labelling in the real-world use case itself, and prevention of data drift.

The initial use case for this technology is for barcodeless item recognition and loss prevention in the grocery retail sector – a large market with significant pain points in this area. Edgify currently operates on thousands of devices running the Edgify framework in the real world, with significant supermarkets and retailers as clients.

Rank had followed Edgify for several years, building an appreciation of the unique effectiveness of the underlying technology as well as the importance and difficulty of real-world edge device ML implementation at scale. Rank led the Seed Extension round in autumn 2022.

Januus is building and delivering the world’s largest (and to our knowledge, only) database that connects cryptocurrency wallets to real-world identities.

As well as making important progress in countering terrorist and criminal financing, Januus is building core infrastructure that will enable governments and other institutions to verify and trust in new payment forms, fostering global financial community adoption of digital currencies.

Having met the founders when they were raising their initial external capital, Rank was impressed by their drive, intelligence and multi-domain mastery. Januus was able to assemble a world-class OSINT team in short order.

Rank invested in Januus’s initial pre-Seed round, followed on in the Foundation round when we connected the dots and introduced Januus to some key sector specific investors. Rank have acted as advisors to Januus.

xUnlocked delivers learning experiences that genuinely help professionals to make decisions that are better for everyone. They operate under the mantra of providing education for you, focused on your industry, your role, and your passion to make things better.

They deliver knowledge, but also give wisdom: the wisdom of those who have lived it, seen it all, and come out the other side as world-leading change-makers.

Having worked with Henry White in another venture, Rank were the first call to invest in this exciting space. The company started life as providing education for Finance Professionals, which was a topic close to our heart. They have since gone on to provide world class Sustainability education and widen their audience in a partnership with Santander.

Rank invested in the Seed/early rounds of xUnlocked and has maintained a board position throughout. The company's last funding round was led by BPP, one of the most prolific education providers in the world.

Apata build modern authentication infrastructure for banks and fintech issuers of credit and debit cards. Their Access Control Server (ACS) is best in class and is winning business from incumbents by providing unparalleled ease of use and customisation. The ACS business has been dominated by a handful of incumbents for over a decade, with little innovation or venture capital involvement due to the inherent barriers to entry for a start up to enter the payment scheme systems. Apata were able to enter this sector as they had form – they had previously built an ACS business.

Having sold their first issuer services business to Stripe, co-founders Shekinah and Niall learnt about the merchant side of the payments sector first hand while working at Stripe post-acquisition. Their unique experience on both the issuer and merchant side of payments have led them to deeply understand the pain points faced by both sides – and how using fraud insights from merchants can help reduce risk and increase throughput for issuers. They are now building the Apata Trust Network alongside their ACS business, creating massive upside optionality on top of what is already a very compelling business case for disruption of a large market.

We were attracted to Apata due to the obvious domain expertise of the founders, in a large and complex sector where domain expertise is absolutely critical. When we heard phrases from other VC investors like “issuer services is my nemesis” and “the sector is too difficult to understand” we knew it was ripe for disruption – and Apata are the team to do it!

Rank led the Seed Extension round in autumn 2023 and have a Board Observer role.

Credable is the Digital Banking Platform that is driving the future of banking by embedding financial services in businesses across emerging markets.

Several billion people and small businesses globally lack access to savings and credit products – they have been bypassed by the global financial services industry due to high cost to acquire/cost to serve vs. lifetime value.

The rise of digital and mobile network based payments systems has opened up the possibility of getting regulatory comfort and distributing, analysing (credit scoring) and running financial services much more efficiently for the couple of billion people left behind.

Having looked at several businesses addressing this market over the years, Rank decided to invest in Credable for a number of reasons:- having known Nadeem for a while and seen his journey in adjacent businesses, we were convinced of his networks, resilience and ability to weather the entrepreneurial journey. With a capital efficient model and best in class tech team, Credable are already serving millions of customers and have a convincing roadmap to building a substantial business which will enable financial inclusion for an extremely large, underserved market.

New opportunity currently securing funding...

Reach out to learn more.

GENERAL ENQUIRIES

FOLLOW US ON

Privacy policy

Disclaimer and Risk Warning